Cost of Living Crisis: 5 ways councils can support their residents and employees

Local authorities know all about managing challenges!

With austerity, welfare cuts and the worst of the pandemic over (although people are still feeling the effects), a new challenge awaits, the cost-of-living crisis!

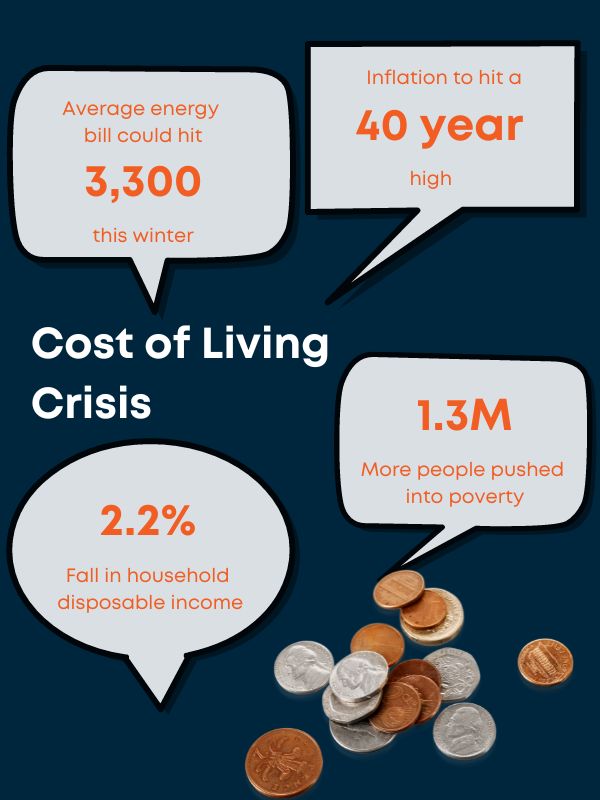

The threat is immediate. People are already struggling with soaring energy bills and rising food prices. The average fuel bill is set to rise to £3,300, and inflation is about to reach a 40-year high! Experts are predicting that millions are at risk of moving into poverty this winter.

This will substantially impact local authorities, social housing providers, and the third sector. Indeed, some councils, such as Eastbourne, have already declared a cost-of-living emergency!

So, what more can Local Government do to help? How can councils increase their employee and community resilience? Here are five suggestions that might help:

-

1. Invest in Income Maximisation

Income maximisation is number one on the list for good reason!

Assisting people to access unclaimed financial support is proven to make a real difference over the medium to long term. It’s not just a temporary sticking plaster.

Shockingly, over £15 billion of financial support went unclaimed last year.

That's why it's essential to check that your residents and low-paid employees are getting the correct income and not missing out.

To do this, councils need to:

-

- Revive their income maximisation/benefit take-up strategies

-

- Invest in income maximisation training for staff and advice services

-

- Make income maximisation everyone's business - to avoid missed opportunities.

-

When done right, Income maximisation helps:

-

- Residents meet their cost-of-living requirements over the medium to long term

-

- Take the pressure off local services

-

- Put money back into the local economy

A win/win for everyone involved.

-

2. Review your debt recovery policy

Have you thought about introducing an ethical debt recovery policy?

In simple terms, this means never asking people to pay more than they can afford and treating people with respect and dignity. To do this properly, councils must conduct a full income and expenditure assessment and consider vulnerability risk and hardship before agreeing on a repayment plan.

Furthermore, there is no point in taking court action against people who have no means to pay. Instead, it’s far more productive to work with people from an early stage and get them the money and debt advice they need. Some councils have even replaced bailiff action altogether with targeted support. This has helped prevent people in debt avoid extra court costs, not to mention its positive effect on their mental health and well-being.

Latest research shows that an ethical approach to debt recovery is more sustainable in the long term and that councils are more likely to recover the money back.

If you are considering reviewing your Council Tax debt recovery policy, you might like to read this guidance from Citizens Advice.

3. Maximise the impact of your Local Welfare Assistance Scheme

Local Welfare schemes provide a lifeline to people experiencing immediate financial hardship. This support could be in the form of a grant, a loan, or some other form of help, e.g. a replacement fridge or another essential item.

The level of support varies from council to council, and while some authorities have robust and progressive schemes in place, others don’t. In fact, some councils don’t have a scheme at all.

If you want to maximise your scheme’s impact, there is plenty of good practice available.

Here is some from the Greater Manchester Poverty Action Group:

-

- Adopt a cash-first scheme, rather than providing vouchers, food aid and goods

-

- Provide a resident-focused scheme that provides wrap-around support

-

- Work with partners to maximise awareness and provide specialist support where necessary

- Reviewing your scheme and adopting best practices will help many residents at this challenging time.

4. Improve skills and support for customer-facing staff

Supporting staff through difficult times is crucial. Without them, you cannot achieve anything.

Austerity, welfare cuts, the pandemic and the Cost-of-Living Crisis, have all taken their toll on your employees. But for customer-facing staff, it has been particularly challenging because

-

Demand has increased, and Customer circumstances have become more complex.

They may be in debt, experiencing family breakdown, poverty and poor mental health. They may also be in hardship and potentially vulnerable. The number of challenging calls and traumatic incidents is also on the rise.

In reality, many people do not have the skills and techniques to manage effectively in these types of circumstances. And even experienced staff members can become emotionally affected by this type of pressure, leading to anxiety, stress, depression, and burnout.

Although targeted training is not the complete answer (more fully trained staff is!), it can make a huge difference. For example: How would you identify and support a vulnerable caller in debt? What would you do if they were experiencing poor mental health or had suicidal thoughts? In reality, many people don’t have the training to handle these situations. But giving people the confidence and the skills can be a life-saver.

As too is giving people the ability to protect their own mental health and well-being and equipping them with the ability to resolve challenging situations compassionately.

5. Invest in the Financial Well-being of employees

The cost-of-Living crisis will disproportionately affect people on a low income, including your employees.

Many employers have well-being strategies in place, but they tend to focus on Mental Health only. Less than 11% of employers actively focused on Financial Well-being as an issue. (CIPD)

This is a missed opportunity, as financial well-being often leads to poor mental health, and so the cycle continues. Focusing on financial well-being, you tackle one of the root causes of poor mental health.

There are many ways to embed financial well-being into your strategy, such as:

-

- Providing financial well-being workshops for employees

-

- Equipping line managers with the skills and knowledge to help their teams

-

- Introducing more salary sacrifice schemes and discount platforms

-

- Directing staff to budgeting support services

-

- Increasing flexibility to manage childcare etc.

But employers must recognise that money is taboo – people don’t like to discuss their finances. So, it’s better to adopt a long-term approach to break down this culture and change people’s habits. This will not happen overnight!

Supercharge employee and resident resilience!

It goes without saying, these measures alone will not solve the cost-of-living crisis or bring it under control. But if done right, they will help to ease some of the anxiety and distress experienced by residents and employees.

If you want to supercharge the resilience of your employees and communities, escalla can help. As well as our comprehensive range of mental health and well-being courses, we offer bespoke well-being learning programmes to suit your requirements.

Please check out our case studies to find out how we have improved skills and resilience in The NHS, Adur and Worthing Councils and Yorkshire Housing Association, among others.

If you’re interested in learning more about income maximisation, please check out our new ‘Helping people with the cost-of-Living’ course.