Maximise income | Reduce spend

Course Overview

Do you want to protect the financial security of your customers and communities? Help to reduce their stress and anxiety? And improve their emotional wellbeing?

Front-line workers are uniquely placed to help their customers and communities tackle the cost-of-living crisis.

Every year over £15 billion in financial support goes unclaimed. This is real money that could make a huge difference to the financial and emotional wellbeing of your customers.

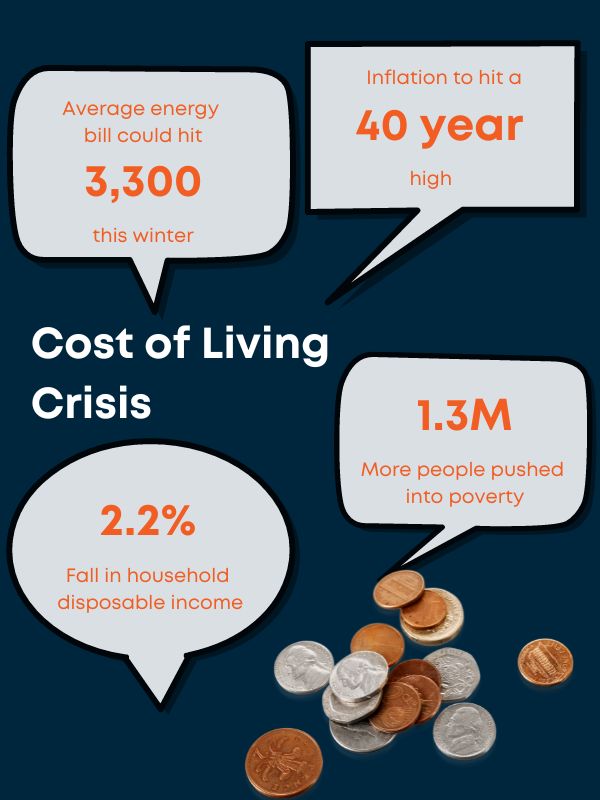

With rising energy bills, fuel and food costs, it’s vital that this money goes where it will make the most difference. In the pocket of your customers!

As well as helping customers directly, this support helps the local economy and helps clients pay their rent, council Tax and other bills and repay debt. It also helps to break the link between mental health and debt and reduces demand on other support services.

In this course you'll learn the fundamental checks you can take to help increase your customers (or employees) income and help them budget and reduce their spend, all without compromising on lifestyle choices.

This course is an essential for front-line staff who support people with welfare assistance, benefits, and council tax. It's also useful for organisations who want to offer more support for staff.

We are not suggesting everyone needs to be an expert, but all front-line workers should at least have an understanding of what support is available. Income maximisation needs to be everyone's business.

What you'll learn:

By the end of the course, delegates will be able to:

- Understand how welfare reforms have adversely impacted customers

- Comprehend the scale of the financial worries customers are faced with

- Recognise how the cost of living crisis impacts customers day to day lives

- Impacts of customers’ financial worries on health, businesses & organisations

- Understand how to carry out a benefits review and what to check

- Learn about different financial support schemes available and eligibility

- Approach a conversation about increasing earnings/capital

- Understand how expenses can be reduced and the 3 main areas to consider

- Examine the ways in which council tax can be reduced

- Personal Budgeting; how to do it correctly and mistakes to avoid

- A masterplan on maximising excess income

- How these solutions can benefit all stakeholders involved